DEFINE YOUR HORIZON™

AWP Resource Library

Free, foundational guidance for First Responders, designed by AWP’s financial planning experts.

BROWSE BY STAGE

Goal-Based Topics

Navigate your retirement with guidance aligned to your goals.

Goal-Based Topics

Navigate your road to retirement with guidance aligned to your goals.

Featured Articles

Program & Plan Guides

Get a better understanding of the basics of the most common retirement programs and plans.

FRS Pension Plan

Learn the basics of the FRS Pension Plan and its benefits, understand pension selection options, and gain insight into ways to maximize your lifetime pension value, and in turn, your DROP.

FRS Investment Plan

Understand the pros and cons of FRS Investment plan, special planning considerations for an investment-only retirement, and insights into portfolio and risk management strategies.

457(b) Plans

Understand how your 457(b) Plans work, when and how you can take withdrawals, how to use your 457(b) for qualified healthcare expenses and investment insights and considerations.

The Deferred Retirement Option Program (DROP)

Understand the Deferred Retirement Option Program (DROP) and its solutions for a flexible retirement strategy.

Featured Articles

Program & Plan Guides

Get a better understanding of the basics of the most common retirement programs and plans.

FRS Pension Plan

Learn the basics of the FRS Pension Plan and its benefits, understand pension selection options, and gain insight into ways to maximize your lifetime pension value, and in turn, your DROP.

FRS Investment Plan

Understand the pros and cons of FRS Investment plan, special planning considerations for an investment-only retirement, and insights into portfolio and risk management strategies.

457(b) Plans

Understand how your 457(b) Plans work, when and how you can take withdrawals, how to use your 457(b) for qualified healthcare expenses and investment insights and considerations.

The Deferred Retirement Option Program (DROP)

Understand the Deferred Retirement Option Program (DROP) and its solutions for a flexible retirement strategy.

Get a free retirement assessment.

See where you stand, and gain insight to guide your next steps.

Retirement Planning Tools

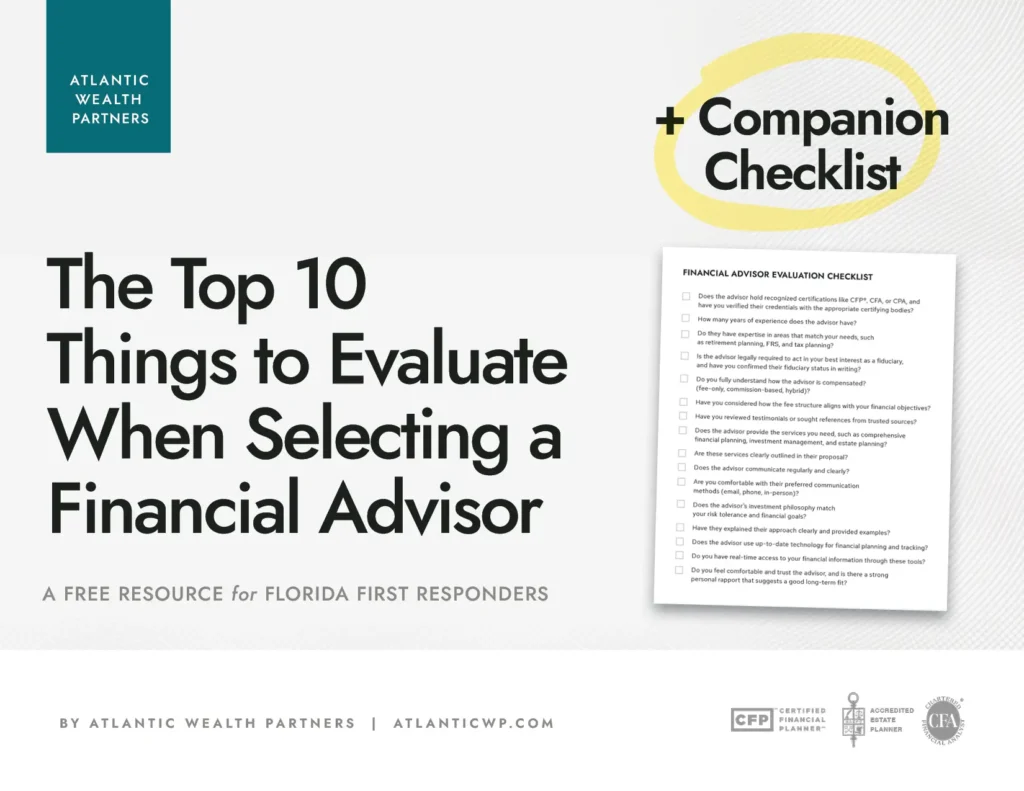

Checklists, self-assessments, and eBooks – all developed by AWP’s financial planning experts.

Retirement-Focused Household Budget Worksheet

Asset Protection Quick Guide: Property & Casualty Insurance, Defined

FRS Pension & Drop: Pre-Retirement Checklist

FRS Pension & Drop: Post-Retirement Checklist

FRS Investment Plan: Post-Retirement Checklist

FRS Investment Plan: Pre-Retirement Checklist

Retirement Planning Tools

Checklists, self-assessments, and eBook – all developed by AWP’s financial planning experts.