FOR FLORIDA FIRST RESPONDERS:

Get ahead of the curve with a FREE retirement assessment.

Gain valuable insights with personalized advice from AWP’s financial & tax planning professionals, who specialize in retirement planning for first responders and understand the ins and outs of DROP, 457(b), FRS Investment and FRS Pension Plans.

- Investment Portfolio Review

- Pension Analysis

- Tax Return Analysis

- Retirement answers

WHAT YOU GET

Personalized Financial Recommendations & Retirement Projections

AWP’s financial planning team will meet with you and your spouse (if applicable) to understand your unique financial circumstances and life goals. Based on the documentation you provide, we’ll offer personalized financial recommendations to help you optimize your family’s financial future.

Investment Portfolio Review (457(b), FRS Investment, IRA’s, Roth Accounts, etc.)

We will review the individual investments held in your portfolio as part of your financial and retirement goals as well as your financial and emotional tolerance to undertake volatility (or risk).

- Investment Portfolio Review & Analysis

AWP will review and analyze each individual investment’s performance, fees, risk and volatility as compared to its peers and as it relates to your retirement and investment objectives in an effort to help you optimize your portfolio performance.

- Investment Portfolio Recommendations

AWP will provide customized portfolio recommendations and advise on any prudent and necessary adjustments and provide you the ‘why’ behind those recommended changes.

Pension Max Analysis

AWP has extensive experience helping first responder clients maximize their pensions. To do this, we must have your service credit history where we can see your earnings history year by year. Our advice may include waiting a year to DROP or retire in order to drop a low year, waiting to DROP until the conclusion of the FRS fiscal year, maximizing the time you have available to sell back and have included it in your pension, or other creative strategies personalized to your individual financial circumstances. Maximizing your pension is also dependent on your familial circumstances and will involve pension option selection (which spousal option you should choose).

- Thorough Pension Review to Maximize Benefits

AWP will review your service history and provide guidance on maximizing your pension which in turn may assist with maximizing your DROP. When it doesn’t, we compare the pros and cons of a higher pension vs. lower DROP based on your financial circumstances.

- Survivor Income Analysis

Selecting a survivor pension option is an irrevocable decision and must be taken very seriously as it cannot be changed once you “retire” on paper and/or enter the DROP. AWP will work to understand your family’s financial situation to make recommendations on which pension option is most appropriate for your family and what that selection means in terms of survivor income for you and your spouse.

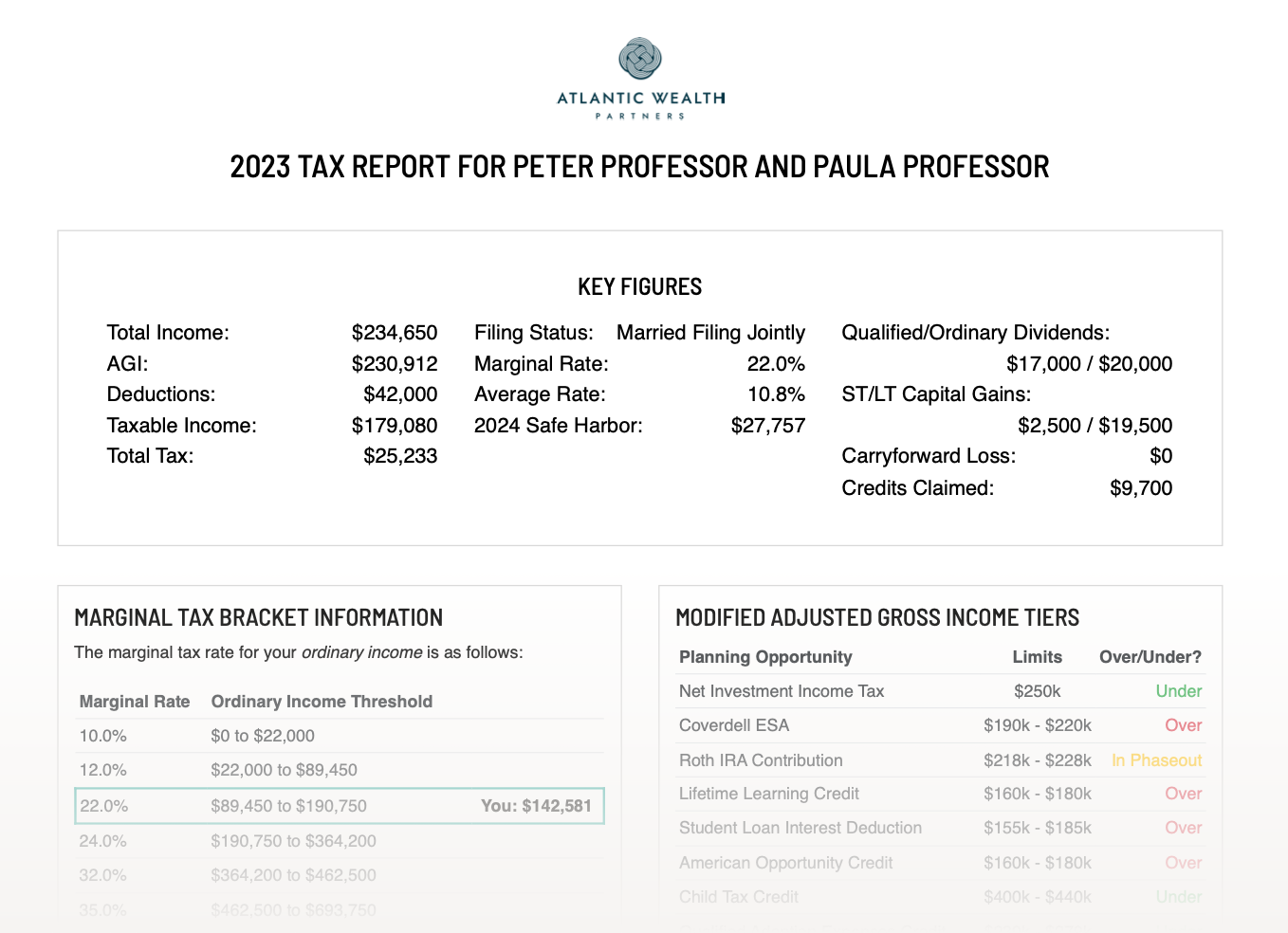

Tax Return Analysis

No one wants to pay more to the government than they absolutely have to. AWP’s team is here to help.

- Tax Return Review

AWP will review your personal and business tax returns to provide guidance on how to minimize your taxes (when appropriate) for current and future years (now and into retirement) as your income changes.

- Tax Minimization Guidance

We will provide clear recommendations on how to minimize your taxes now, the year you retire, and into your retirement years when you have RMD (required minimum distribution) obligations from your tax protected accounts. We will also help you to better understand the basis for the amount of taxes you have paid and provide you guidance on adjusting your withholdings so you may be able to avoid having to make a large tax payment unexpectedly.

Retirement Guidance

After your meeting with the AWP team and the review of your financial, legal and tax documents, we will have a 2nd meeting to provide you additional insight into where you’re at compared to where you want to be.

- Personalized Financial Recommendations

After reviewing your family’s unique financial circumstances and portfolio, the AWP team will provide you with a set of tailored financial recommendations intended to guide you towards the achievement of your stated financial goals. It is through this process that we aim to provide you with the reassurance that you are on the right track towards your planned lifestyle in retirement and to provide advice that enhances your overall financial outlook now and into the future

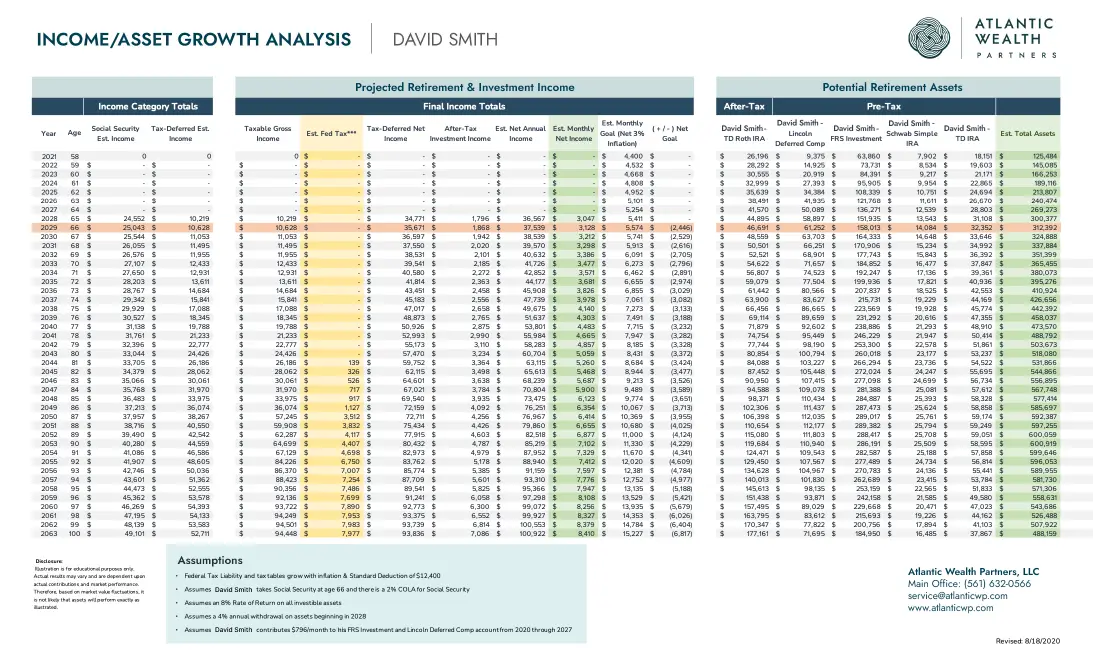

- Personalized Retirement Income & Asset Projections

After reviewing your financial information, the AWP team will provide you with a projection of your retirement income and assets, including DROP and retirement timing, when and why to pull social security and how you should draw off your investment accounts to minimize your tax exposure.

- Who is this right for?

First Responders, Age 45+

- You are either preparing to enter DROP, exiting DROP, 3-5 years out from exiting FRS Investment, or already retired.

$750k of Investments

- You have (or will have) at least $750k in DROP, FRS Investment or 457(b) Deferred Compensation investments at the time of retirement

Seeking Expert Guidance

- You value expert help because you want to be sure you're on track with retirement and your family's financial security.

How It Works

It’s as easy as four easy steps and requires just a little commitment of your time to help you achieve peace of mind and take the first steps towards planning you and your family’s financial future.

Introductory Call

Info Gathering

The Assessment

Your Decision

Helping Florida's First Responders Retire Well Since 1999.†

Atlantic Wealth Partners (AWP) has built a legacy of trust and expertise in financial planning for over two decades. Our deep understanding of the unique challenges faced by first responders has allowed us to provide tailored retirement and financial planning solutions.

Our legacy is rooted in dedication, longstanding relationships, personalized service, and a deep commitment to supporting the financial well-being of those who serve our communities. See the history of our firm and how we have been catering to the needs of Florida’s First Responders since 1999 here.

† As the Center for Wealth Planning from 1999-2017. 1As of 4/1/2024.

When you work with Atlantic Wealth Partners, you get more than just an advisor – you gain a team of experienced professionals that are held to a higher standard of financial planning and estate planning, working to guide you through your financial journey with the respect, and integrity you deserve.

Q&A

Answers to some of our most commonly asked questions.

Why should I consider hiring AWP?

AWP provides personalized financial planning and wealth management for Florida first responders. We know DROP, FRS Pension Plan and Investment Plan, and 457(b) programs inside-and-out, and have a deep understanding of the unique considerations for financial planning and portfolio management needs of these families. Our 25+ year relationship with the Palm Beach County PBA is indicative of our expertise, honesty, integrity and longstanding commitment to support Florida First Responders.

How does AWP make money?

AWP charges 0.375% per quarter or 1.50% annually of assets under management. This fee is based on the value of your investments on the last day of the prior quarter and is billed in advance. AWP does not bill when providing guidance on FRS Investment accounts.

The following services are included in that cost for all clients. We take a holistic approach to managing your wealth and personal finances, providing comprehensive services to ensure every aspect of your financial life is optimized for success:

Portfolio Analysis – Assessing risk and return, asset allocation, manager performance, and reducing or eliminating hidden investment fees.

Customized Investment Strategy – Crafting a personalized portfolio using the appropriate combination of strategic and tactical asset allocation.

Fee & Tax Optimization – Reducing costs and improving tax efficiency through direct investment in individual securities whenever possible.

Liquidity & Tax Management – Helping you maintain control over liquidity and tax implications.

Proactive Estate Planning – Regularly reviewing your estate plan to align with your financial and legacy goals.

Comprehensive Risk Assessment – Evaluating your property, casualty, and life insurance to identify potential liabilities and ensure adequate protection.

Goal-Based Financial Planning – Defining short- and long-term financial objectives and creating a step-by-step plan to achieve them.

Smart Spending & Saving Strategies – Designing a realistic and sustainable household budget (as necessary).

Credit & Debt Solutions – Addressing credit challenges, improving your score, and finding the best ways to reduce debt (as necessary).

Expense Reduction & Savings Maximization – Identifying opportunities to cut costs and free up cash for future goals.

Financial Snapshot & Analysis – Understanding your net worth, debt-to-income ratio, and key financial metrics to make informed decisions.

Do you offer an hourly or one-time project fee option?

AWP does not offer hourly or one-time financial planning fee options. AWP puts the effort in up front to demonstrate its expertise and relies on the “Golden Rule”.. the principle of treating others as one would want to be treated by them.

How involved will AWP be in the management of my investments?

AWP acts on a fully discretionary basis for all accounts it manages. This means that AWP can make changes to your portfolio on an as-needed basis which ensures that we can act in a timely manner and that each of our clients receives the same, consistent high-level of service and attention to their portfolio.

AWP requires a meeting with all clients at least bi-annually, however, for us to rebalance any accounts that are not held at Schwab, we will need to do a screen share session at least once per quarter.

How are my accounts protected?

All accounts with AWP are held at a qualified custodian (such as Schwab), and AWP only has the authority to trade and bill our advisory fees to your account.

How are you different from other financial advisors?

AWP is a fiduciary, meaning we are legally and ethically required to act in our clients’ best interest. While there are many advisors these days who are fiduciaries, we are further set apart by our high touch services, experience, and expertise specific to the addressing the unique investment and financial planning needs of Florida’s First Responders.

Do you only work with first responders?

The vast majority of AWP clients are first responders and support personnel, however, we will assist your other non-first responder friends and family provided they come through a warm referral from an existing client.

Can you work with people in other states?

Absolutely! AWP not only works with clients throughout the State of Florida, but as far West as the State of Washington and as far North as New Hampshire. Many of our clients start with us while they are working or preparing for retirement, and with our digitally focused platform we are set up to continue to help service them anywhere in the US.

How does AWP select the investments it recommends?

AWP’s investment selection starts with a simple approach… Asking ourselves the following:

- “Would I personally own this investment?”

- “Why would I want to own this investment?”

- “Why should I own this investment?”

- “What risks are associated with the ownership of this investment?”

- “Are those risks reasonable given what the client objectives are?”

We utilize a highly analytical approach towards identifying, reviewing, analyzing and selecting investments which includes factors such as:

- Investment performance compared to peers in the same asset class

- Historical manager performance

- Historical volatility

- Underlying fees and expenses

- Investment fundamentals

- Historical yield and dividend payment

- Underlying financials and fundamentals

- Technical trends

- Wall street analyst reviews

- Macro and micro economic conditions

All investments are monitored using a top-down and bottom-up approach focused on not only the individual historical and anticipated future performance, but how that ties to each individual client’s financial objectives and risk tolerance. These factors are monitored on an ongoing basis and changes are made as necessary on our client’s behalf.

How often will I meet with you?

It really depends where you are in your retirement journey.

Our recommendations are typically as follows:

In Retirement

- with a Pension = 1-2 x annually

- Investments Only = 2-3x annually depending on comfort level with your retirement income plan and the market

Before Retirement

- Transitioning into Retirement = a series of 3-4 Meetings pre and post-retirement to guide you through the transition process.

- <3 years to Retirement = 2x annually

- 3-6 years to Retirement = 1x annually

- 6+ years to retirement = at least bi-annually

Bottom line is, we’re here for you as much or as little as you need us, depending on your comfort level.

Will I have just one advisor at the firm?

AWP takes a team approach, and you will build relationships with all of our team members.

We choose to work as a team for several reasons, namely:

- To allow our clients to leverage the specialized expertise of each individual team member

- To ensure that your relationship always remains intact and that there is appropriate knowledge of your unique financial circumstances across all members of our team – minimizing any potential for disruption should the team evolve or change over time

- To bring our clients the added benefit of having access to differing viewpoints from our collective expertise rather than relying on the vision of one

STEP ONE

Schedule Your Intro Call

Use the form below to book time with us.