Whether you’re a firefighter, police officer, paramedic, or support personnel, your pension is one of your most valuable benefits, and maximizing it can mean a more secure and comfortable retirement. Understanding how your FRS Pension Plan works can make a huge difference in your financial future.

Key Facts: The FRS Pension Plan

Defined Benefits

The FRS Pension Plan is a defined benefit plan, meaning your retirement income is calculated using a specific formula. This formula takes into account your years of service, final average compensation (AFC), and a benefit multiplier. This type of plan provides predictable and steady income, which is crucial for long-term retirement planning.

Cost-of-Living Adjustments (COLA)

To help your retirement income keep pace with inflation, the FRS Pension Plan includes annual cost-of-living adjustments (COLA). These adjustments ensure that your purchasing power remains strong as prices rise over time.

Survivor Benefits

The FRS Pension Plan offers survivor benefits, allowing you to provide for your loved ones if something happens to you. You can choose from several options to ensure your spouse or designated beneficiaries continue to receive income after your passing.

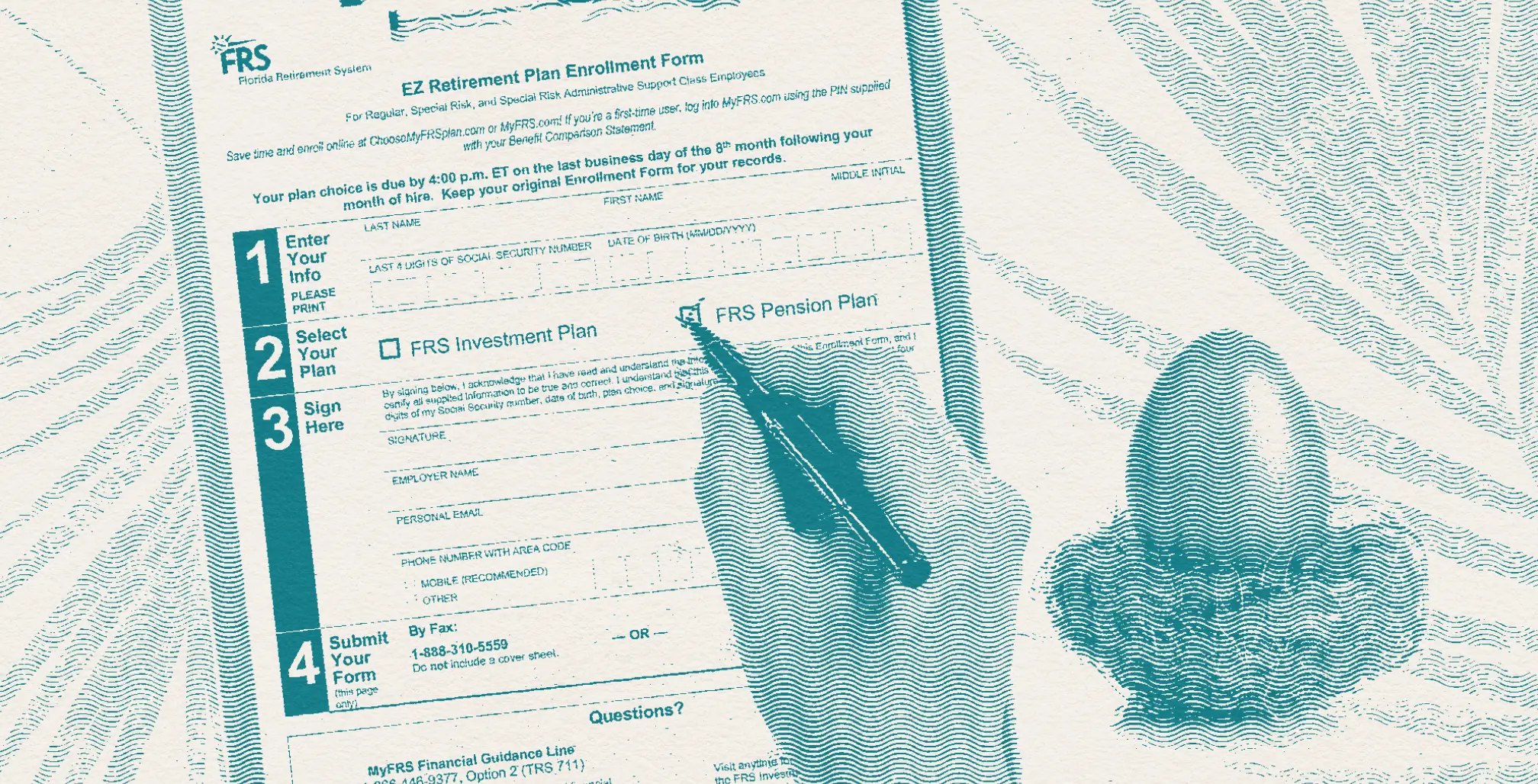

Eligibility & Enrollment

Eligibility for the FRS Pension Plan is generally available to all full-time and part-time employees of participating employers, which include state, county, district, and certain city governments. Enrollment in the plan happens automatically when you start working, so there’s no extra paperwork needed to join.

Pension Options

The FRS Pension Plan provides four different payout options, each with its own set of benefits and trade-offs. These include the Single Life Annuity, the 10-Year Certain Option, the 100% Joint Survivor Spousal Option, and the 66 and Two-Thirds Spousal Option. Selecting the right option is essential for aligning your retirement income with your financial needs and goals.

Pension Max

Pension Max strategies aim to increase the value of your pension benefits. These can include selecting different payout options, using life insurance to supplement survivor benefits, and optimizing your retirement plan contributions

How Are Pension Plan Benefits Calculated?

Your retirement benefits under the FRS Pension Plan are determined by a formula that considers your average final compensation (AFC), length of service, and membership class. For those hired before July 1, 2018, the AFC is based on your highest five years of earnings. If you were hired after July 1, 2017, it’s based on your highest eight years.

Below, we’ve included an example that illustrates how pension benefits are calculated for a first responder in the FRS Pension Plan.

Example: Calculate Your Pension Benefit

Let’s say you are a law enforcement officer who has worked for 30 years and you’re considering retirement. Your Average Final Compensation (AFC)—the average of your highest five years of salary—is $150,000. As a Special Risk employee, your percentage value per year of service is 3%.

The pension benefit formula is as follows:

- Benefit = Years of Service × AFC × Percentage Value

For a 30-year career:

- Pension Benefit = 30 years × $150,000 × 3% = $135,000 annually

If you decide to continue working beyond the 30-year mark, every additional year you work increases your benefit by another 3% of your AFC, to a maximum of 99%.

Back-Loaded Benefits: How It Works

The FRS Pension Plan is designed with a back-loaded structure, meaning your benefits grow more significantly the longer you work. For example, each additional year you work beyond a 30-year career as a law enforcement officer or firefighter can increase your pension by another 3% of your AFC. This back-loaded growth makes it advantageous to continue working if you’re able, especially in higher-paying roles.

Example Scenario: Back-Loaded Benefits

David, a first responder in Florida and a member of the FRS Pension Plan, starts his career with a salary of $44,000 annually. After 25 years of service and receiving a few promotions, David’s average final compensation (AFC) rises to $130,000. For a participant in the ‘Special Risk’ Class, the combined employee and employer contributions to the FRS Pension Plan are based on 19% of salary—3% from the employee and 16% from the employer:

- Initial Annual Employee & Employer Contributions at Hire (on $44,000): $8,360

- Pre-Retirement Employee & Employer Contributions (on $130,000): $24,700

Assuming David selects FRS Option 1, his pension would be approximately $8,125/month or $97,500/year. Over a 25-year retirement, his pension benefit is valued at $2,437,500*.

In comparison, if David were to participate in the FRS Investment Plan instead, accumulating the same pension benefit would require substantial annual contributions. To match the $97,500/year in pension payments, he would need to contribute approximately $30,840 annually over his career**. “Achieving this level of contribution would require a starting salary of $162,315 in the first year—an unrealistic expectation for any new hire.”

This example clearly paints the benefits of the pension plan and how benefits accumulate based on the tail-end of one’s career.

*Assumes a 4% withdrawal rate. **Considers an 8% Average Annual Rate of Return for 25 Years.

Maximizing Your FRS Pension Plan

To get the most out of your pension, focus on maximizing your AFC in the years leading up to retirement. Consider taking on higher-paying roles, overtime, or specialized assignments that can boost your annual salary. Since your AFC is based on your highest earning years, these strategies can significantly impact your final pension calculation and increase your lifetime retirement income.

For a detailed look at strategies designed to maximize your FRS Pension Plan as well as a closer look at Pension Plan Options, read our in-depth article here.

Choosing the Right Pension Plan Option

As you get closer to retirement, it’s important to analyze and plan carefully to ensure you choose the right Pension Option for your family and health needs. Remember, once you make your decision, it’s set in stone. Below are the four Pension Plan options.

Option 1: Single Life Annuity

Pays for the life of the member. No Survivor Benefit.

Option 2: 10-Year Certain Life Annuity

Provides a reduced monthly benefit for your lifetime, with a guarantee that your beneficiary will be eligible for a continuing benefit for 10 years from the date you retire. After 10 years of retirement, no benefits are payable to your beneficiary in the event of your death. If you outlive the 10 years following your retirement, your beneficiary will receive no additional payments.

Option 3: Joint & Survivor Annuity (100%)

Provides a continuing survivor benefit to your spouse or a child under age 25 (or older if they have special needs) without any reduction in the survivor benefit.

Option 4: Joint & Survivor Annuity (66 ⅔%)

If your joint annuitant passes away before you, the pension reduces to 66 2/3% of what it is at the time of death. Pays a survivor benefit to your spouse or a child under age 25 (or older if they have special needs).

Check out our Pension Plan Options Pros and Cons Article here >>

As you can see, each option has different implications for your monthly payments and survivor benefits. It is essential to understand these options thoroughly and select the one that best aligns with your financial goals and family needs. Consider consulting with a financial advisor to help you make an informed decision.

Getting Your Timing Right

The timing of your retirement can significantly impact your benefits. Working longer can increase your years of service and final average compensation, resulting in higher monthly benefits. Additionally, reaching certain age milestones may qualify you for enhanced benefits or reduce penalties for early retirement. Careful planning and consideration of these factors can help you maximize your retirement income.

Combining Benefits with Other Retirement Plans

If you have other retirement savings plans, such as a 457(b), 401(k) or an IRA, coordinating withdrawals with your FRS Pension Plan benefits can optimize your overall retirement strategy. Using a combination of income sources can provide flexibility and tax advantages, helping you to manage your retirement income more effectively. Again, it’s best to hire a professional to make sure your strategy is tax-smart and makes sense for your individual goals and needs.

AWP’s Pension Max Quick Tips

Maximize Your FRS Pension Plan Benefit

Your FRS Pension Plan benefit is calculated based on your years of service, your Average Final Compensation (AFC), and a percentage value per year of service. Increasing your salary in your final years can significantly boost your pension. Consider taking on higher-paying roles, overtime, or specialized assignments to maximize your pension benefit.

Leverage DROP

The Deferred Retirement Option Program (DROP) allows you to accumulate your pension in a separate account while continuing to work. Timing your entry into DROP can impact your retirement savings significantly, with the option to extend your participation up to 8 years for further growth.

Utilize 457(b) Plan Contributions

Take full advantage of your 457(b) plan’s contribution limits. In 2024, you can contribute up to $23,000 with an additional $7,500 if you’re over 50. A 3-year catch-up provision allows you to defer up to $46,000 per year during your final three years, maximizing your retirement savings. Unlike 401(k) or IRA accounts, 457(b) plans don’t impose early withdrawal penalties if you retire before age 59½. This provides more flexibility in accessing retirement funds early without additional costs.

Select the Right Spousal / Pension Option

The FRS Pension Plan offers four payout options, including choices with or without survivor benefits. Weigh the pros and cons of each option, keeping in mind the financial security of your loved ones.

Want to dive deeper into strategies for getting the most out of your FRS Pension? Read our complete guide to pension max here.

Conclusion

The FRS Pension Plan can a secure and steady source of retirement income for Florida first responders. Start planning early and make informed decisions to get the most out of your FRS Pension. Schedule a free consultation with our team to explore your options and optimize your benefits.

ARTICLE SOURCES

Florida Retirement System. “Pension Plan Handbook.” 2024. https://frs.fl.gov/forms/Pension-Plan-Handbook.pdf.

Florida Retirement System. “The Florida Retirement System Pension Plan.” 2024. https://www.myfrs.com/FRSPro_Pension.htm#who

Florida Retirement System. “Pension Plan Overview.” 2024. https://www.myfrs.com/FRSPro_ComparePlan_Pension.htm.

PENSION MAX EXPERTS

Work with a team that specializes in Pension Max for Florida first responders.

AWP has helped hundreds of first responder families maximize their FRS Pension Plan benefits. Schedule a consultation with us to see how we can help you make the most of your pension.