Minimizing taxes in your retirement year can be quite tricky. While many people are concerned with minimizing their taxes (who actually likes to pay more than they have to?!) and will follow the generalized statement that, “retiring earlier in the year is better than later in the year from a tax standpoint”, when you truly understand the way personal income taxes work, this may not be the best advice. The truth is, everyone’s situation is different. There are so many factors at play.

Top 10 Factors That Determine Into Your Retirement Date

Income the Year Before

How much income you and your spouse (if married) will personally generate for the tax year prior to retirement.

Tax Deferral

Whether you and your spouse are (or can) leveraging tax advantaged accounts (deferring your tax liability into the future) such as a traditional 457(b), 403(b), 401(k), etc.

Owning a Business

Whether you own a business and the circumstances around that business.

Lump Sum Payment

How much sick, vacation, comp or other time will be paid out to you in a lump sum when you retire.

Spouse’s Retirement Date

The timing of your spouse’s planned retirement (if applicable).

Retirement Income

Your family’s annual income needs vs. available income in retirement (how much you might earn from your pension or investment distributions).

FRS Pension or FRS Investment

Whether you are in the FRS Pension or FRS Investment programs.

Your Dependents

How many dependents you are currently providing for and the nature of those expenses.

Age & Tax Exposure

Your age, your spouse’s age (if applicable), anticipated tax exposure today and projected future tax exposure based on your retirement income plan. (Are you likely to end up paying more today or more in the future on the same bucket of money?)

Active-Status Real Estate Professional

Do you or your spouse qualify as an active real estate professional?

The reality is that the only way to determine the best time to retire is by understanding how all of these factors impact that decision. In order to make the right decision though, it’s important to understand how tax brackets work – they are incremental.

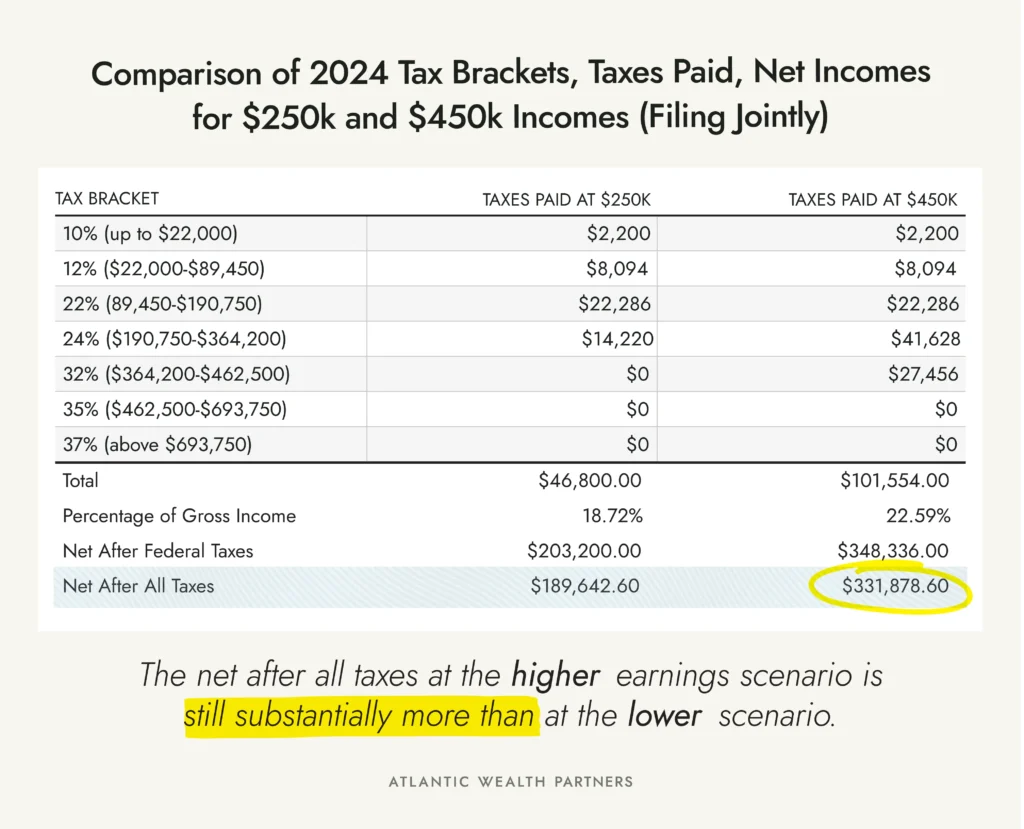

Many people think that when they “hit the next tax bracket” that it forces them to pay a higher tax rate on all of their income. This is not the case. Just take a look at the examples are below at $250,000 in household income and $450,000 in household income:

What this means is that in nearly all cases (there are limited exceptions) working with us to MAXIMIZE your benefits is the #1 solution to minimizing your taxes. Meaning… that while your taxes may not actually be lower, receiving/earning MORE money and paying slightly more in taxes is nearly always more beneficial than earning less and paying slightly less taxes. This is why you shouldn’t let the tax tail wag the dog, so to speak.

Key Strategies for Minimizing Taxes in Retirement

Now, once we understand where you and your family are at with regard to points #1 to #10, we have helped you MAXIMIZE your benefits with your employer and your income, AND we have determined that tax deferral is best (because you’re likely to pay at a lower tax bracket in the year you retire, rather than the future based on your income plan).

Then, we can help you plan to save taxes using some of the following strategies:

Maximize Deferral

Contribute the maximum allowable amount to your 457(b) + catch up contributions available. Currently $23,000 + $7,500 if you are over age 50 (total of $30,500 for each of you and your spouse or potential $61,000) or leverage the “Three-Year Catch Up Provision” to put $46,000 annually away + a spouse over age 50 would provide for a deferral opportunity of $76,500 ($46,000 + $30,500) or $92,000 if both are eligible for the “Three-Year Catch Up”.

2024 Three-Year Catch-Up Provision:

The three-year catch-up provision is beneficial for those nearing retirement who want to maximize their retirement savings.

Contribution Limit: Under this provision, you can contribute up to twice the annual limit in the three years before your designated retirement age. The three-year catch-up contribution limit is calculated by the plan administrator, considering your past contributions and eligibility. For 2024, this means you could contribute up to:

- $46,000 (2 x $23,000) per year during each of those three years.

Eligibility: The three-year catch-up is only available to participants who have not contributed the maximum amount in previous years. The additional contributions are limited to the unused amounts from prior years when the participant did not contribute the maximum allowable amount.

Contribution Guidance: Contribute the maximum allowable amount to your spouse’s 457(b), 401(k), 403(b) or Traditional-IRA.

Something to Think About

You cannot use both the age 50+ catch-up provision and the three-year catch-up provision simultaneously; you must choose one.

Maximize Deductions

For those with large payouts, maximizing itemized deductions in your retirement year can reduce taxable income. This could include medical expenses, property taxes, and charitable donations. Click here to see the top 10 tax deductions commonly available to retirees.

Charitable Contributions

Consider “bunching” deductions, donating appreciated assets (instead of cash) or using a Donor Advised Fund to pre-fund future charitable contributions to reduce your taxes.

If you own a business…

Planning to purchase a new retirement vehicle? Consider purchasing a vehicle over 6,000 pounds and creating a tax deduction out of it using a Section 179 deduction. Here’s how it works.

Investment Property as a Real Estate Professional

Consider purchasing an investment property and utilizing a cost segregation study to use accelerated and/or bonus depreciation to create a tax deduction, especially if you are a real estate sales agent, general contractor or in real estate trade or business as a side business (or your spouse is when filing jointly) Click here for an explanation of how it works. Note: AWP has relationships that can help you implement this strategy, so that you can benefit, but not have the full responsibility for the management of the property.

Final Word

By implementing these strategies, you can better manage your tax liabilities and ensure a smoother financial transition into retirement and even better, maximizing the money you and your family keep in your pocket!

There are other strategies that may be available depending on your individual scenario. Contact AWP to better understand your options.