February Market Recap & Outlook

Markets

After the enthusiasm of a record S&P 500 closing level above 5,000 on February 9th, the market was not feeling any Valentine’s Day-eve love from the January inflation reading, which came in hotter than expected on the morning of February 13th. The S&P 500 saw its largest selloff in almost a year, dropping 1.37% on that day. Digging into the numbers, the Consumer-Price Index (CPI) rose 0.3% in January and 3.1% over the last year, remaining elevated in part by inflation in services. As most of us can attest, businesses are simply passing on the cost of increased expenses to consumers in the form of higher prices. By and large, consumers have accepted those price hikes instead of altering their spending habits. Until consumer spending begins to wane, inflation will prove to be stickier than Fed Chair Jerome Powell would like to see in order to begin a much-anticipated rate cutting cycle.

The mid-month pessimism was short lived, however, as the market continued its rally toward one of the best February’s in nearly ten years. For the month, the S&P 500 finished +5.2% and the Dow Jones Industrial Average finished +2.1%. Not to be outdone, the Nasdaq set a closing record on the final day of the month after the Personal Consumer Expenditures (PCE) report brought a bit more good news for the rally. The good news being simply that the January PCE came in line with expectations, though most were bracing for a hotter number. The annual pace of inflation remains below 3%, but still not near the desired 2% level that would bring about lower interest rates from the Fed.

Both inflation readings in February generally pointed to the same conclusion; any interest rate cuts may be pushed further out on the calendar, and the size of the cut may be less than market participants are hoping for.

Outlook

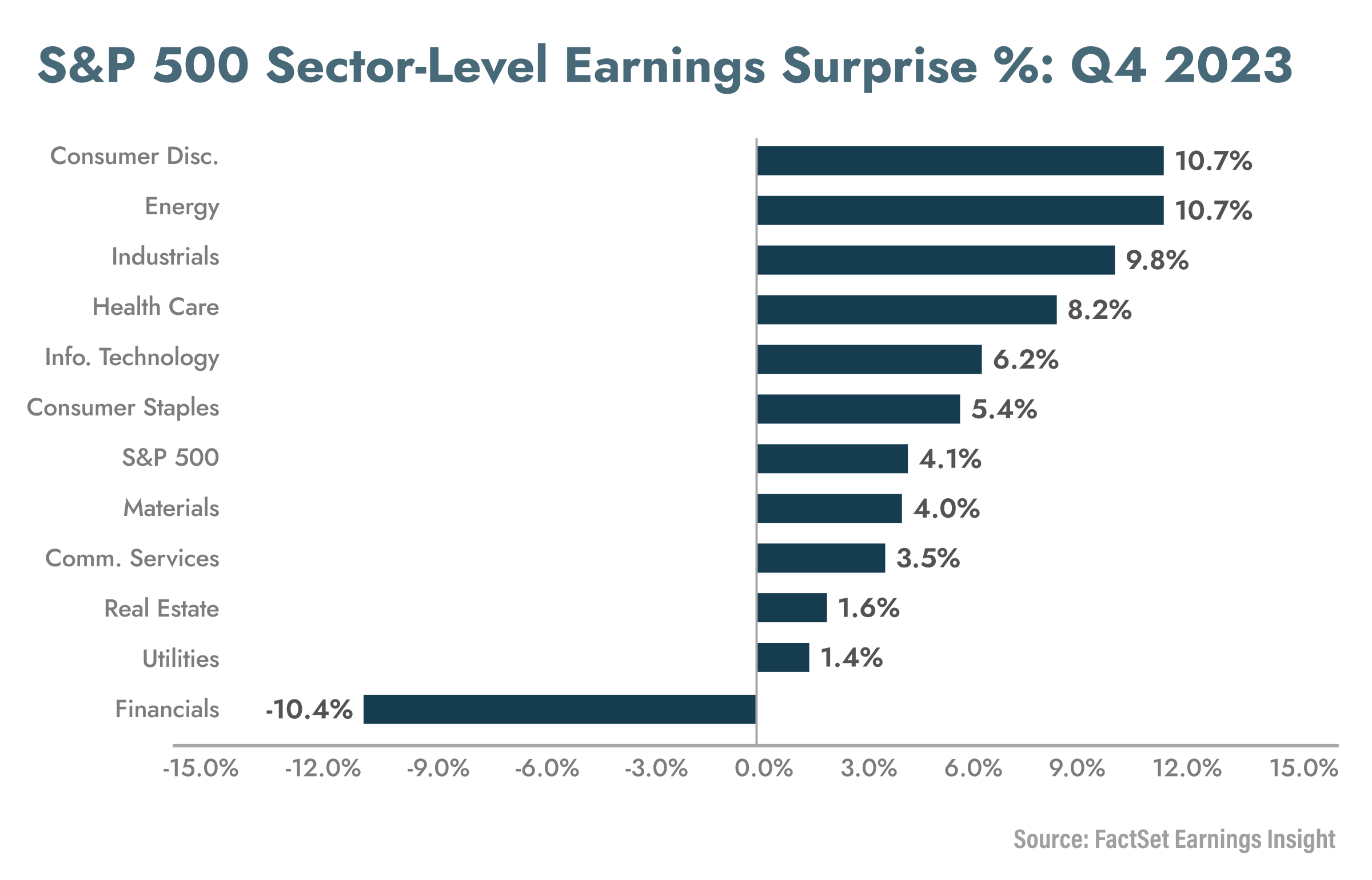

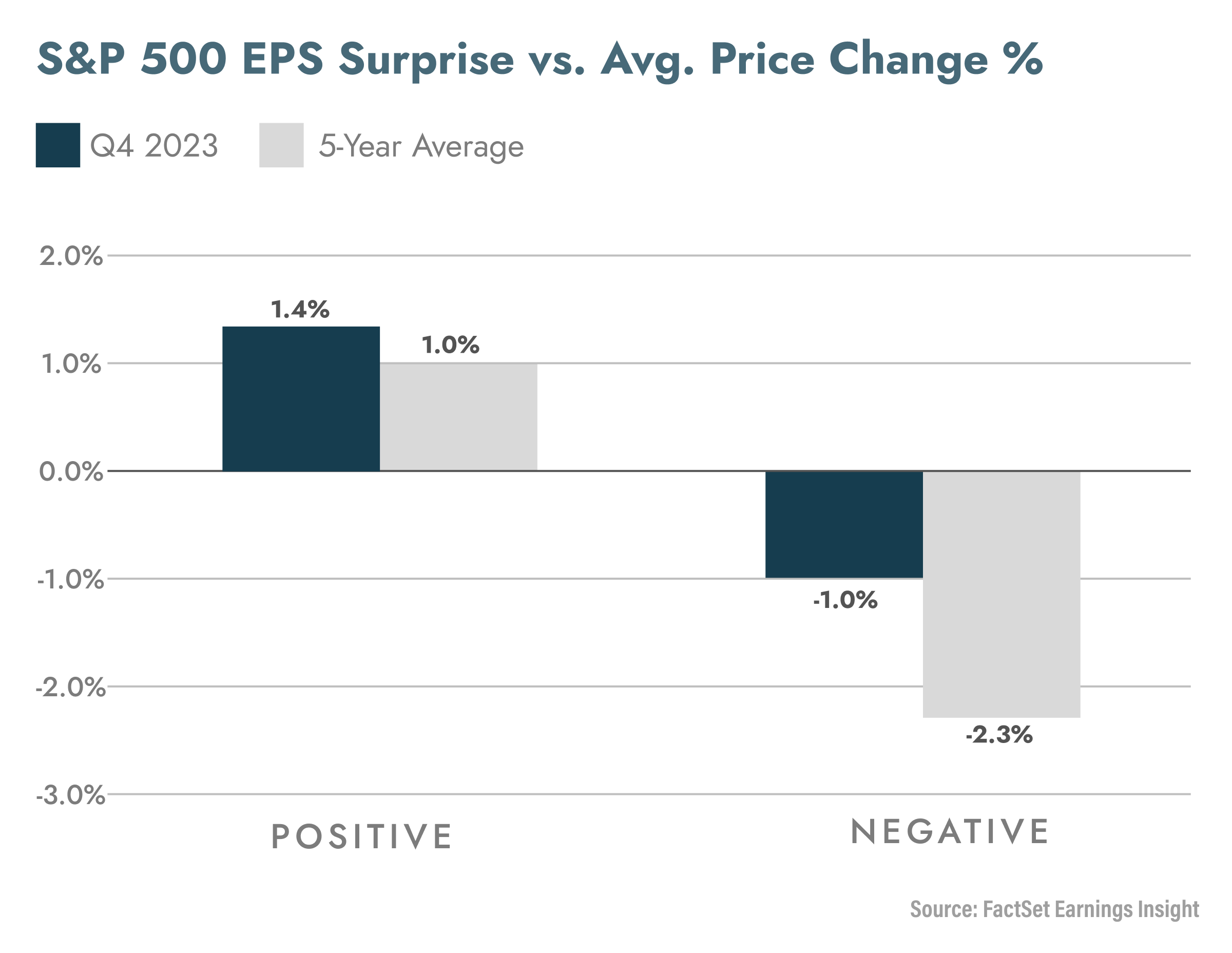

The so-called Magnificent 7 gets all the hype these days, and for good reason. These mega-cap stocks have been almost solely responsible for driving the rally for some time. So, it was little noticed last month that the breadth of the market extended support to the positive momentum. More than 71% of the stocks in the S&P returned positive gains for the month, a healthy sign that gains are not as dependent on just a small group of companies. This can be attributed in part to roughly 73% of S&P 500 companies beating earnings per share (EPS) estimates for the 4th quarter of 2023. Though this is mostly in line with the 10-year average of 74%, the market is rewarding positive EPS surprises more than usual (1.4% gains after earnings release vs. 1% gains being the 5-year average; chart below). One reason could be that though expectations for the quarter were somewhat muted, companies have delivered profits with a mix of expense-cutting measures coupled with easing input costs. The hope is that these savings will be sticky moving forward. For the full year, the projected EPS growth for S&P 500 companies is anywhere from 8-10%. Analysts expect profits to be supported by an improved US economic outlook as well as stronger profit margins.

Source: FactSet Earnings Insight

Source: FactSet Earnings Insight

As we move into the final month of the quarter, there is no shortage of upcoming data releases that will test the market. The bias thus far has been to the upside, but we were reminded again in February that volatility lurks behind every headline. Our team is diligently working to navigate your financial horizon. Here we remind you to embrace the long view while preparing to weather any storms.