January Market Recap & Outlook

Markets

Stock indexes experienced a sharp decline to end the first month of the year, with the S&P 500

registering its most substantial drop since September. Despite the decline on Wednesday, the S&P still

logged its third straight month of gains. Looking ahead, earnings season continues to ramp up this week

and into February. So far, the pace has been a mixed bag for investors. A majority of companies that

have reported have topped EPS expectations, but with recent gains in the market, the reaction thus far

has been muted. Regardless, the ongoing strength in profits reported is encouraging, particularly with

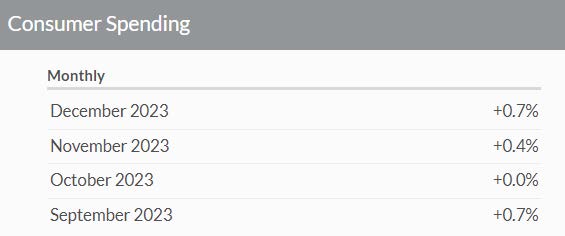

no consumer slowdown concerns to point to, as the below charts show.

Source: Bureau of Economic Analysis

Outlook

2024 could not have begun more differently than 2023. A year ago, the consensus was that a recession

was looming, and that the economy would contract or remain flat, with the expectation of full year GDP

growth of 0.3%. The reality of consumer strength and a tight labor market resulted in 3.1% GDP growth

in the fourth quarter of 2024 compared to 2023. The consensus now is that the economy will continue

to grow this year, albeit at a slower pace, with projections of 1.5-1.7% real GDP growth in 2024. At the

moment, optimism is strong that the economy will avoid a recession and growth will be healthy.

On Wednesday, The Federal Reserve, in its first policy meeting of the year, decided to maintain its

benchmark federal-funds rate within the range of 5.25% to 5.5%, the highest level in over two decades.

Here are some takeaways from the event:

- Fed Chair Jerome Powell clarified that the Fed would not lower rates until it was confident that

inflation was moving sustainably toward the 2% target. - Despite market expectations suggesting a 50% likelihood of a rate cut in March, Powell

expressed skepticism about a rate cut at that time. The market-based probability of a rate cut in

March fell to around 35%, reflecting that change in sentiment. - Investors are still expecting a total reduction of nearly 1.5% in interest rates this year.

- This view may prove too optimistic, however. If the first cut is now expected in June, it is unlikely

the Fed would accelerate further rate cuts in the 4 months thereafter leading into the

Presidential election in November. - If inflation holds steady, and there is no meaningful uptick in unemployment, ending 2024

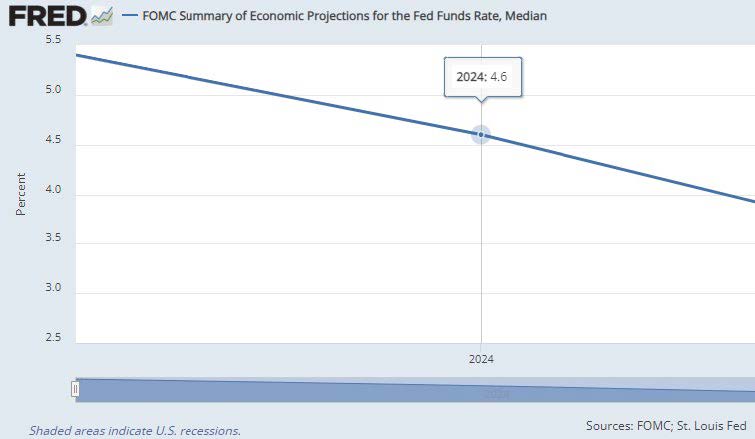

within the range of 4.25-4.5% for the federal-funds rate is a more conservative baseline view.

You need only look at the Fed’s own 4.6% projection for 2024 below:

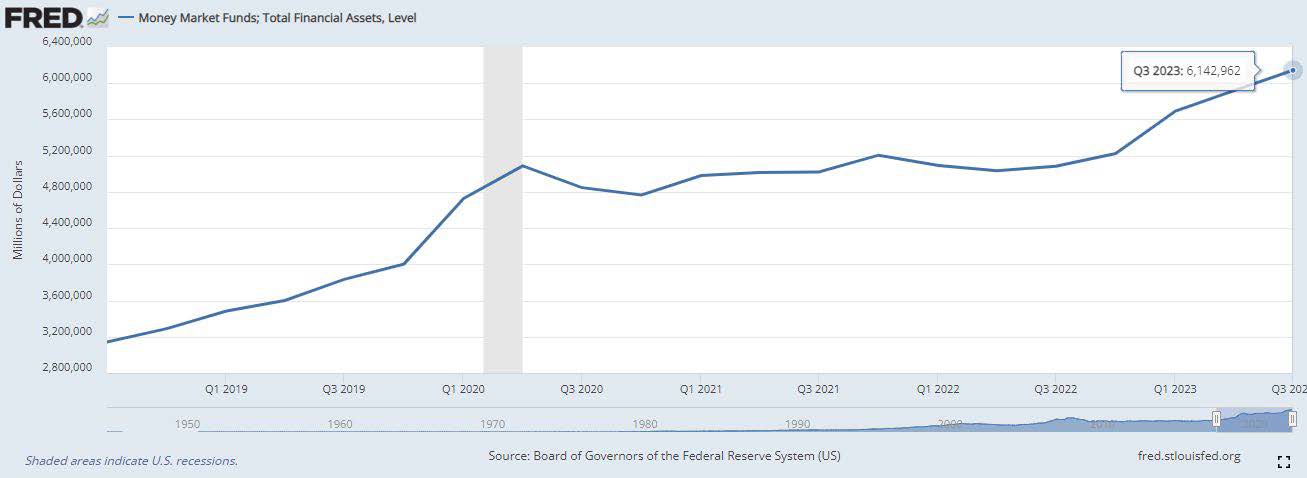

As the year progresses, one trend we will be watching closely is how quickly assets move off the sideline,

and how that will impact the broader market outside of the ‘magnificent 7’. Last year, a substantial cash

influx of more than $6 trillion moved into money market funds (see chart below). This marked a

significant asset allocation trend that was fueled by recession concerns, and a nearly 5% yield made

these funds an attractive safe haven. However, with expectations of rate cuts ahead, cash returns are

likely at their peak for the first half of 2024, and these money market funds will likely experience

drawdowns as cash is invested elsewhere. How and where those funds are directed, and the confidence

in the economic data the Fed is watching, will go a long way in dictating how the year ahead plays out.

How does all of this economic data impact you? For starters, it is important to understand we are

officially out of a ‘tightening’ cycle, meaning interest rates have officially peaked. Going forward, the

expectation for this year is that interest rates will come down. The uncertainty is around the pace of

that decline, whether the Fed can proceed slow and steady as intended, needs to pause, or some

economic event forces a more aggressive hand. In any scenario, lower interest rates are good for both your personal finances as well as market returns. It allows companies to lower their costs of capital, boosting profits, and also invites additional investment across asset classes, allowing companies and the economy to grow. Despite all the uncertainty we detailed above, our team is diligently working to navigate your financial horizon. Here we remind you to embrace the long view while preparing to weather any short-term storms.