March Market Recap & Outlook

Markets

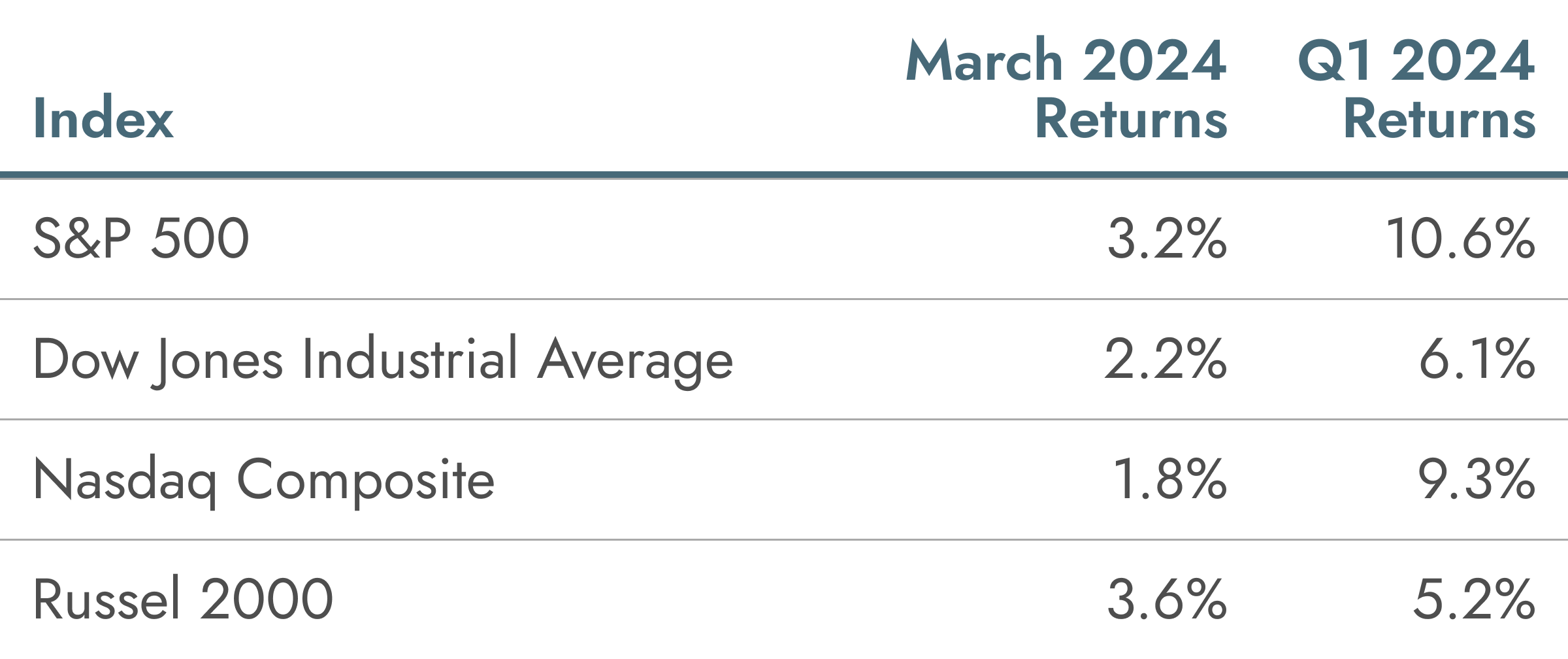

Equities continued their rally from the prior month, closing out March with a 3.2% gain for the S&P 500, 2.2% gain for the DOW, and a 1.8% gain on the month for the Nasdaq. Continuing with the theme we discussed in February of a broadening market rally, small caps outperformed large caps for the month, with the Russell 2000 gaining 3.6% in March.

Investors mostly shrugged off the slight increase in inflation that was reported, and instead chose to focus on the 11th straight month of a decrease in core inflation:

- The Core CPI was reported at 3.75% for February, compared to 3.86% in January and 5.54% in February 2023. This is still higher than the long-term average of 3.68% but shows continued signs of progress.

Outlook

The focus recently seems to be entirely on a discussion around when, and by how much, the Fed will cut interest rates this year:

- The market consensus is still projecting 3 rate cuts of 0.25% each to bring the Fed Funds rate down to a range of 4.5-4.75% by year end.

- Reporting companies appear to be managing their cost of capital just fine. According to FactSet, in Q1 the EPS estimate for the calendar year 2024 decreased by 0.4% (to $243.60 from $244.47). During the past 20 years, the average decline in the annual EPS estimate during the first three months of the year has been 2.1%. This points to a higher degree of optimism in corporate profits than usual.

- The optimism extends to the broader economy as well, as consumers’ discretionary spending has not shown signs of easing. With a higher level of interest rates, you would expect consumers to curtail spending and the economy to contract as a result.

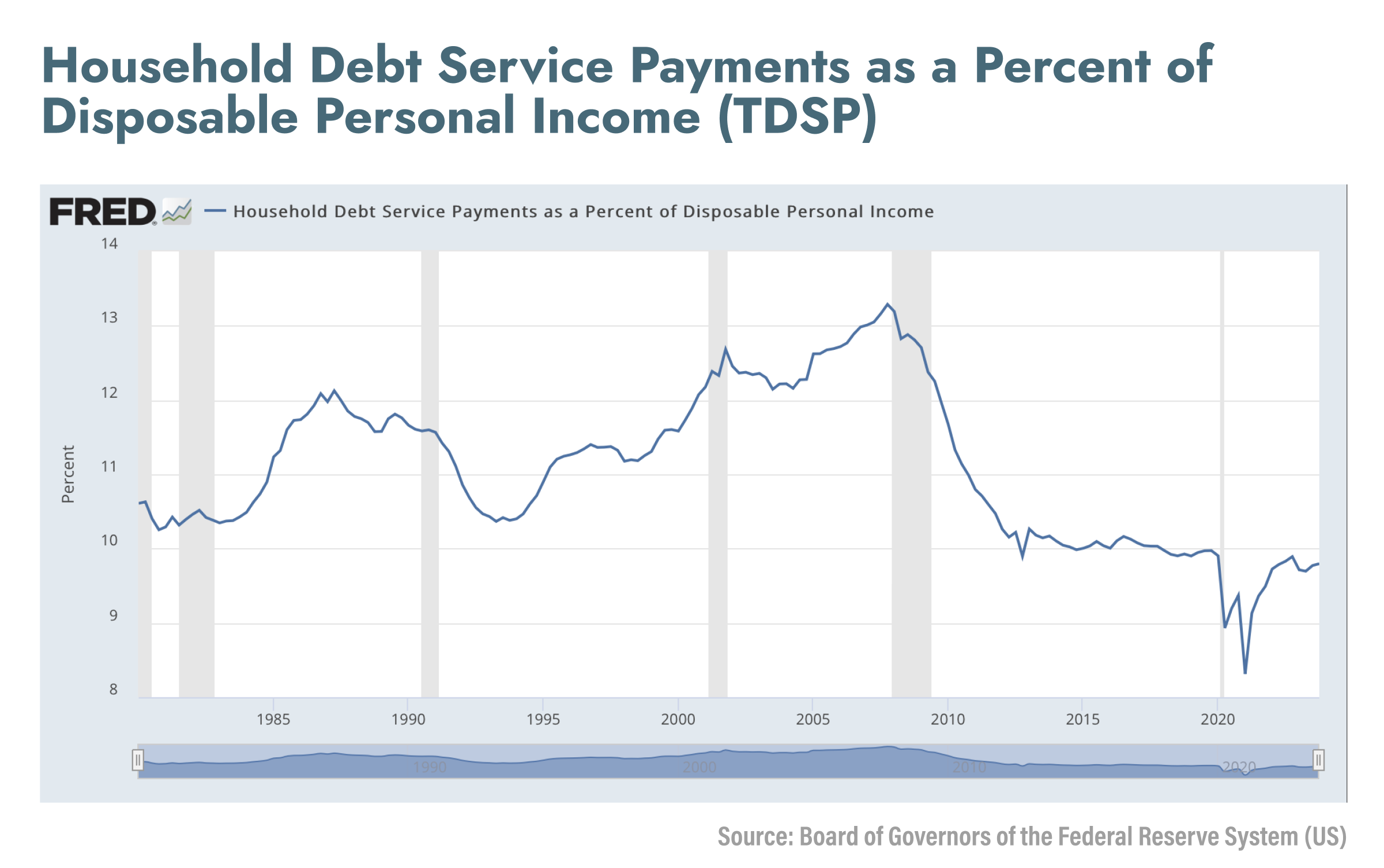

The chart below shows that Household Debt Service Payments as a Percent of Disposable Personal Income is not as elevated as expected. In fact, at 9.79% in Q4 2024, it is still below the 10-year average, and has not been meaningfully above 10% since 2011.

- There are a variety of reasons for this, including the low financing and mortgage rates that were locked in during the zero-interest rate policy era, as well as excess cash from government stimulus that people have held onto. Rising incomes due to inflation, which would offset an increase in debt service by raising personal income, are another factor.

- The point here is to illustrate that even though consumers are noticing the pinch in higher prices from inflation, they have not meaningfully seen the impact from higher rates on debt service. Whether or not that negative impact will be needed in order to fully fan the flames of inflation remains to be seen.

Source: Source: Board of Governors of the Federal Reserve System (US)

We think it’s important to remain focused on your long-term investment goals, remembering the timeless wisdom: “This too shall pass.” Should you have any questions or concerns, we’re here to help you navigate them.