Under the One Big Beautiful Bill Act that was signed into law on July 4, 2025, Congress established a new kind of child savings vehicle called Money Accounts for Growth and Advancement (MAGA), otherwise known as ‘Trump Accounts’. These accounts are intended to give children a financial head start by allowing contributions that grow tax-deferred until the child reaches adulthood. The accounts are structured similarly to traditional individual retirement accounts (IRA’s) in the tax code, but with special rules tailored for pre-retirement use and contributions.

Who can open and contribute, and when?

You can file the form to elect and establish the account before contributions begin on July 4, 2026. Children who are U.S. citizens born between January 1, 2025 and December 31, 2028 for whom a Trump Account is established will receive a deposit from the federal government of $1,000 into that account. The new IRS form (Form 4547) will be used to elect to establish a Trump Account and trigger the one-time $1,000 seed contribution from the Treasury for eligible children. The seed contribution is a pilot program to start, hence the expiration date, and Congress may extend it with future legislation.

Families and others can contribute up to $5,000 to the accounts per year. Contribution limits will be indexed to inflation and contributions are not tax deductible. Employers may make an annual contribution of up to $2,500 that will not impact the employee’s taxable income, but will be counted towards the $5,000 annual contribution limit.

In addition, eligible charitable organizations may contribute on behalf of all children within a defined “qualified class,” such as all children born in a particular year or time frame, or all children residing in a state or county, as examples. This provision has already garnered attention with the $6.25 billion charitable commitment announced by Michael and Susan Dell’s philanthropy. This gift will be distributed as a contribution of $250 to the first Trump Accounts of 25 million American children aged 10 and under living in Zip codes with median incomes below $150,000.

What about children born prior to January 1, 2025?

An account can be opened for any child born prior to January 1, 2025 who is under the age of 18 and has a valid Social Security number. These accounts will not receive the initial $1,000 seed investment, but will have all of the other tax advantaged features once the account is properly established.

When is the money accessible, and for what purpose?

The account is in the child’s name and a responsible adult manages it while the child is a minor. Once the child is of age, after the ‘growth period’, standard IRA early-distribution exceptions may apply (e.g., higher education or first-time home purchase, see the full IRS list of exceptions). Prior to age 59.5, non-qualified withdrawals will be subject to a 10% early distribution penalty, similar to the restrictions placed on traditional IRA’s.

What is the potential for growth?

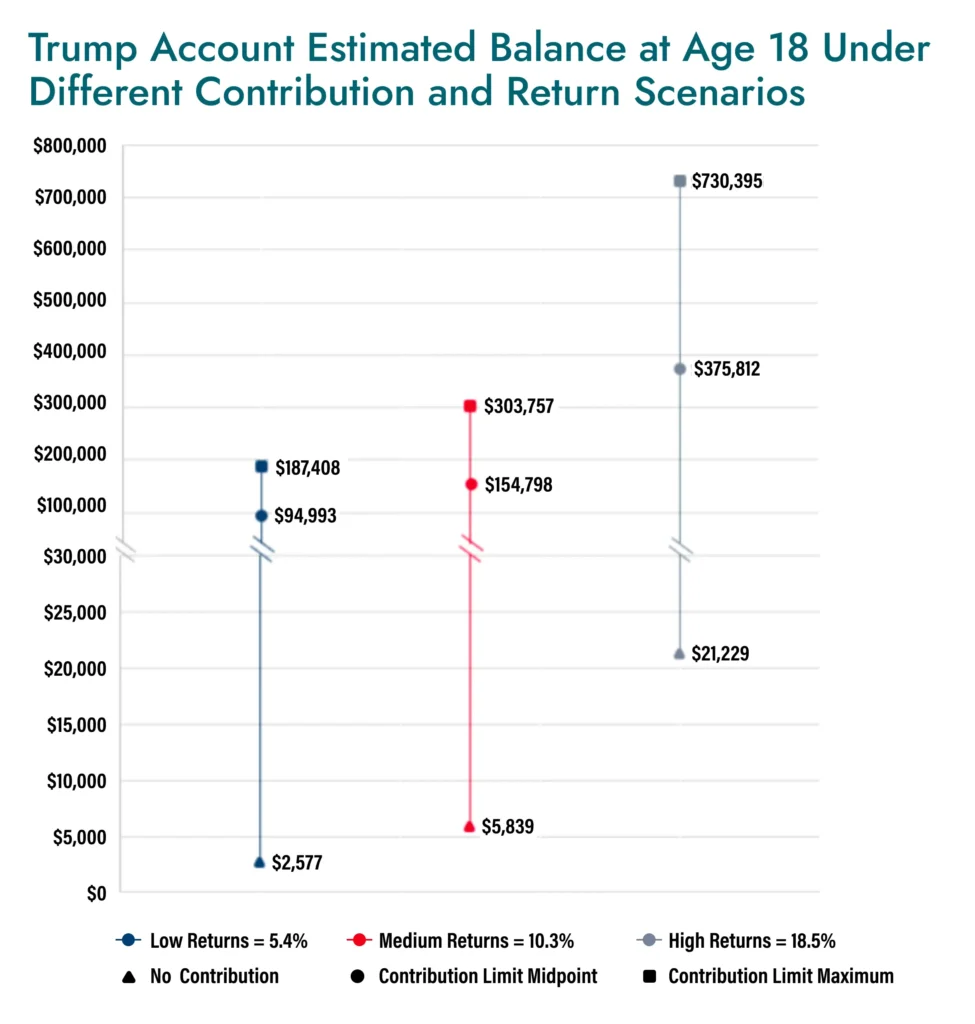

Per the law, the accounts must be invested in equity market mutual funds or exchange-traded funds mirroring the S&P 500 or another American stock index that do not utilize leverage and charge no more than 0.10% in annual fees. The Council of Economic Advisors posted the following graph outlining the potential returns in three different return and contribution scenarios. They range from contributing nothing and letting the $1,000 deposit grow at the low end of their annually compounded projected returns, to contributing the maximum amount per year and growing the accounts at the high end of their annually compounded projected returns. (Chart below)

What comes next?

Some key details are yet to be ironed out. However, the IRS Form 4547 to elect and establish the account in the child’s name is available to be filed at any time, or along with your 2025 income tax returns. Once the form is filed and the election is made, Treasury will send further instructions to complete the account opening sometime around May 2026. More information can be found by visiting www.trumpaccounts.gov

The Bottom Line

Parents are always looking to give their kids an edge that sets them on the right path in life. Children exposed to investing can develop better financial literacy, understanding concepts like risk and diversification, as well as developing foundational habits for generational wealth building. Giving kids a tangible stake in the growth of the economy is a great way to set up future generations for success while also teaching valuable lessons on effort, choice, and outcomes in our society. Just in time to celebrate 250 years of American independence, these new accounts offer a lasting gift of opportunity and prosperity by investing in our nation’s future.