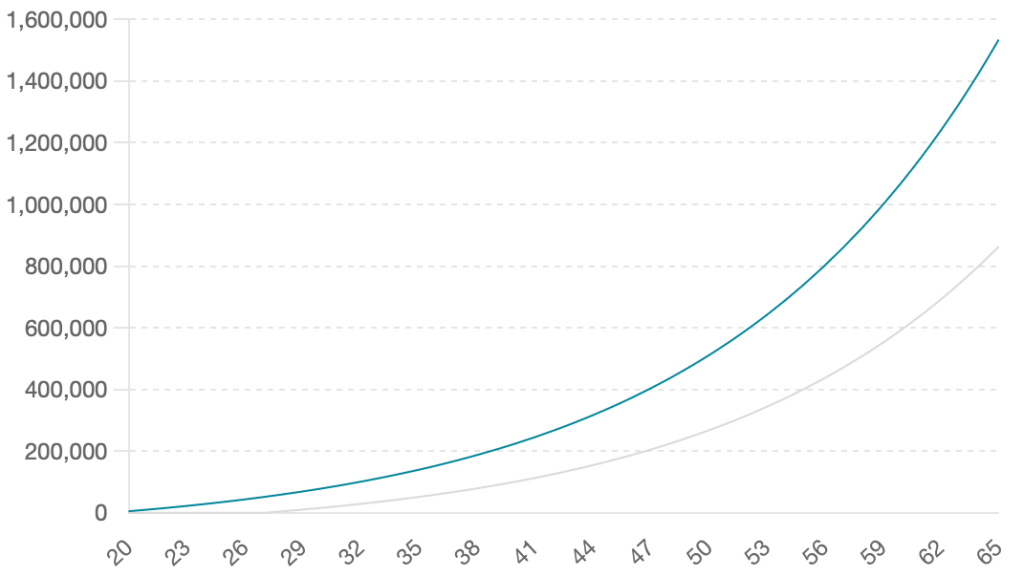

Most of us have heard the term ‘compound interest’ before, but do you fully understand how it works and how important it is to start early? Compound interest is when you earn interest on interest. The longer the time period the more ‘compounding’ of your account value (the higher the value).

Below is chart to demonstrate the of the value of compound interest showing two individuals. Individual 1 contributes $5,000 per year to an investment account for eight years from age 20 through age 27. Individual 2 contributes $5,000 per year to an investment account from age 28 through age 65. The values at age 65 are almost identical.

Comparison Of Compound Interest With Different Contribution Strategies

Individual 1Individual 2

The effects of starting this investment just 8 years earlier are astronomical. Individual 1 only contributes $40,000 compared to $190,000 for individual 2. The cost of waiting for Individual 2 is over $150,000 out of pocket! If in the illustrated example individual 1 contributed $5,000 from age 20 through age 65 their ending account value would be $2,259,501 (almost double individual 2) from just starting 8 years earlier.

We have had clients tell us that in the past that they focused on other priorities earlier in their careers and then they are trying to play catch-up the last handful of years before retirement. Not realizing how different their retirement would look if they had started earlier. This all starts with proper planning – and making a phone call to get started.