One of the key areas of focus in the second Trump administration has been extending the centerpiece legislation from his first administration, the Tax Cuts and Jobs Act (TCJA) of 2017.

Many of the provisions in the TCJA were set to expire at the end of 2025, making it necessary to get the new legislation passed in an orderly fashion this year, which the administration did by signing the One Big Beautiful Bill (OBBB) into law on July 4th.

Below, we’ve highlighted several provisions in the new legislation that could have implications for your taxes, savings, and planning decisions.

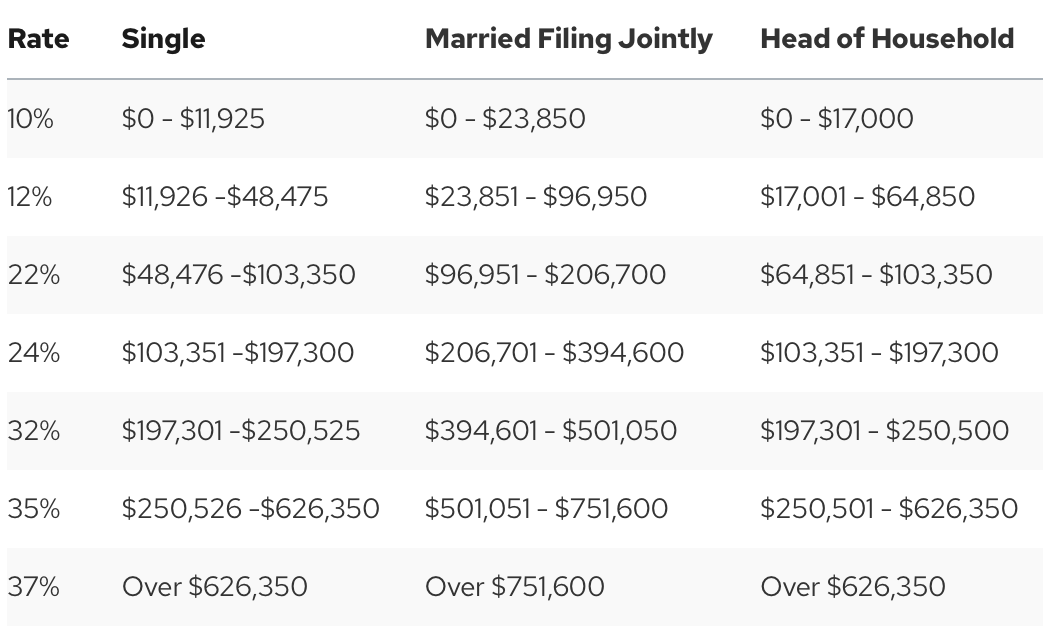

Personal Tax Rates

As mentioned above, the main purpose of the bill was to make permanent the lower individual and corporate tax rates that were put into effect in 2017, and avoid one of the largest tax increases in history if they were left to simply expire at the end of 2025. The seven progressive tax rates created by the TCJA are now permanent and will be indexed to inflation. For 2025 they are as follows:

Increased Standard Deduction

The higher level of standard deduction that was put in place with the TCJA is now permanent, and will be indexed to inflation going forward. For 2025, the standard deduction for single filers is $15,750, for married joint filers it is $31,500, and for head of household it is $23,625.

Child Tax Credits

The Child Tax Credit is now permanent, and has increased to $2,200 per child starting in 2025, with future adjustments indexed to inflation. Families with dependents who do not qualify for the Child Tax Credit may qualify for the Other Dependent Credit, which has been kept at $500 but is also now permanent.

State & Local Tax (SALT) Increase

Under the TCJA, the State and Local Tax deduction was reduced to $10,000. This amount has been increased to $40,000 for 2025 through 2029, increasing 1% per year before reverting back to $10,000 in 2030. This larger deduction phases out for filers earning more than $500,000 (married filing jointly) or $250,000 (single).

Tax on Tips and Overtime

Beginning in 2025 through 2028, and only for eligible employees, there will be no federal tax on reported cash tips up to $25,000 per year. The benefit will phase out for individuals earning more than $150,000, and more than $300,000 for those married filing jointly. The IRS was instructed to officially publish an eligible employees list by Oct 2, 2025. Those that “customarily and regularly” received tips through December 31, 2024, will be eligible. Those that “customarily and regularly” received tips through December 31, 2024, will be eligible.

Beginning in 2025 and through 2028, certain workers will be able to deduct up to $12,500 (single) or $25,000 (married filing jointly) of eligible overtime pay from their federal taxable income. It applies only to qualified overtime compensation under the Fair Labor Standards Act (FLSA), which is the time-and-a-half pay earned by non-exempt workers, and only “the pay that exceeds their regular rate of pay – such as the “half” portion of “time-and-a-half” compensation” would count towards the deduction. The benefit will phase out for individuals earning more than $150,000, and more than $300,000 for those married filing jointly.

Deductions for Seniors

Beginning in 2025 through 2028, those 65 and older will be able to take an additional $6,000 federal income tax deduction (in addition to the standard deduction). The deduction phases out for filers earning more than $75,000 (single) or $150,000 (married filing jointly). For those married filing jointly, the amount can be deducted per spouse, for a total of $12,000 if both are 65 or older.

Car Loan Interest Deduction

Beginning in 2025 through 2028, and only for new U.S. assembled vehicles purchased in those years, you can deduct up to $10,000 per year in auto loan interest (in addition to the standard deduction). The deduction will phase out for individuals earning more than $100,000, and $200,000 for those married filing jointly.

Estate Tax Exemption

Beginning in 2026, the individual estate tax exemption threshold was increased to $15 million (from $13.99 million) for individuals, and increased to $30 million (from $27.98 million) for married couples.

The exemption applies to combined lifetime gifts and estate transfers, and you will not owe federal estate tax unless your estate exceeds these thresholds. Above these new thresholds, the 40% estate tax rate will apply only to the amount above the exemption.

Make America Grow Again (MAGA) Accounts

Make America Grow Again Accounts are an exciting feature of the OBBB that will need to be detailed further in the coming months. Every baby born in the United States between 2025 and 2028 will receive an initial one time $1,000 contribution from the government, which will be invested in a low-fee, diversified U.S. equity portfolio that utilizes no leverage.

These accounts will only be seeded with $1,000 from the Treasury for newborns during this period, however every child under age 8 on January 1, 2026 will be eligible to create an account (without a government contribution), and parents and relatives can add up to $5,000 per year in after-tax contributions.

The accounts will grow tax free without distributions until the child reaches 18, when up to 50% of the account may be withdrawn for higher education, small business expenses, and first time home purchases (as well as other specific situations). At age 25, the full amount of the account can be withdrawn for those qualified expenses. At age 30, withdrawals can be taken for any use.

529 Education Savings Accounts

Starting in 2025, 529 funds can cover a broader range of K‑12 expenses, including curriculum materials, tutoring, online modules, and testing fees among other items.

529 distributions are now also tax-free for higher‑education credentials and vocational/trade certifications, such as CPLs, HVAC training, welding certificates, or licensing exams.

Starting in 2026, the annual tax‑free withdrawal limit doubles from $10,000 to $20,000 per beneficiary for eligible K–12 expenses.

Other Notable Provisions

- The newly purchased $7,500 EV tax credit and $4,000 used EV credit both expire on September 30, 2025.

- The EV charger installation credit (30% up to $1,000) and other residential clean energy incentives end June 30, 2026.

- Starting in 2026, taxpayers can only deduct up to 90% of their gambling losses against gambling winnings, reduced from the previous 100% allowance.

- The bill restores and makes permanent 100% bonus depreciation for most tangible personal property (e.g., equipment, machinery, software) placed in service after January 19, 2025, ending the previously scheduled phase-down from 60% to 0% by 2027. Businesses can now expense the full cost upfront of eligible assets, allowing additional tax and cash-flow advantages.

What’s the difference: Tax credit vs. Tax Deduction

A tax credit is a dollar-for-dollar reduction in the amount of tax you owe after your taxes owed have been calculated. A tax deduction is reduction in your taxable income, which lowers the amount of income that is subject to the taxes owed calculation.

WORK WITH AWP

Understand the Impact on Your Plan

The new legislation brings lasting changes to tax rates, deductions, and retirement planning rules. If you’re unsure how it affects your financial picture—or want help putting new opportunities to work—schedule a consultation with AWP to review your plan.